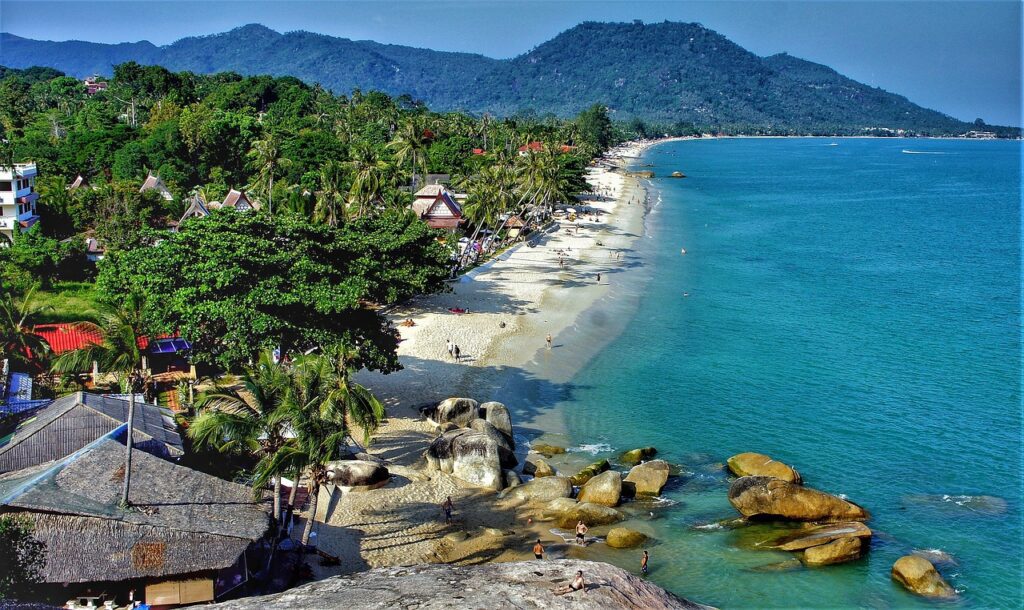

Investing in real estate development projects in Koh Samui offers an exciting pathway for those seeking to take advantage of the island’s rising appeal as a prime tourist hotspot. Known for its pristine beaches, tropical allure, and continually improving infrastructure, Koh Samui is becoming a focal point for luxury villa developments, resort investments, and high-end condominiums. For real estate investors, this tropical paradise presents both immediate potential for growth and long-term gains.

However, it’s essential to recognize that, like any real estate investment, purchasing property in ongoing development projects comes with its share of risks and challenges. Navigating these complexities—whether related to construction timelines, legal considerations, or market volatility—requires thorough research and a strategic approach.

In this article, we’ll dive deeper into the exciting opportunities awaiting real estate investors in Koh Samui’s development scene, while also highlighting the potential pitfalls to be aware of. By understanding both the rewards and risks, you’ll be better equipped to make informed decisions in this rapidly evolving market.

Opportunities in Koh Samui’s Real Estate Development Market

The real estate market in Koh Samui presents numerous opportunities for investors, especially those interested in development projects. From the potential for significant capital appreciation to tapping into the high demand for luxury properties, there are many benefits to entering the market at the pre-construction stage. These projects not only offer the possibility of high rental yields but also allow investors to diversify their portfolios while securing long-term financial growth.

Early Investment Benefits

One of the most attractive aspects of investing in a real estate development project is the opportunity for capital appreciation. When you invest in a property during its pre-construction phase, you typically secure it at a lower price compared to its post-construction value. As the project progresses, demand for these properties tends to increase, often leading to significant value appreciation by the time the development is completed.

Additionally, developers often offer flexible payment plans to early investors, which allows for financial flexibility. Payments can be spread over the construction period, making it easier to manage cash flow while securing a property in a prime location. This not only reduces immediate financial strain but can also lead to substantial capital gains in the future.

High Demand for Luxury Properties

The rising demand for luxury villas, high-end condominiums, and resort properties in Koh Samui is one of the key drivers behind its thriving real estate market. The island’s reputation as a premium tourist destination continues to grow, attracting high-net-worth individuals and luxury travelers seeking exclusive accommodations with private pools, ocean views, and top-tier amenities.

For real estate investors, this high demand presents an ideal opportunity to invest in luxury development projects. Properties located in prime locations—such as beachfront villas or hillside estates with panoramic sea views—are especially sought after and often command higher prices. These luxury properties not only offer strong rental yields but can also generate substantial resale value, making them a lucrative option for investors looking to capitalize on the island’s expanding tourism sector.

Diversification and Passive Income

Investing in real estate development projects in Koh Samui also provides an excellent way to diversify your investment portfolio. By adding high-quality real estate assets to your portfolio, you reduce risk while positioning yourself for passive income opportunities. Once the property is completed, investors can choose to rent it out to short-term or long-term tenants, generating a steady stream of rental income.

Given Koh Samui’s status as a year-round destination for international tourists, the demand for vacation rentals remains consistently strong. Many investors choose to list their properties on platforms like Airbnb and Booking.com, where luxury villas and high-end condominiums attract premium rates. The combination of rental income and property appreciation offers an attractive long-term investment strategy that can result in both short-term gains and long-term financial security.

Risks Associated with Real Estate Development Projects

While there are numerous opportunities in Koh Samui’s real estate market, investing in ongoing development projects comes with certain risks. These risks must be carefully considered to ensure the protection of your investment and to make informed decisions.

Delays in Project Completion

One of the primary risks when investing in real estate development projects is the potential for construction delays. These delays can stem from various factors, including regulatory hurdles, weather disruptions, financial challenges, or supply chain issues. For investors, any delay in project completion means postponed income from rentals or reselling the property, which can affect overall returns.

To mitigate the impact of such delays, it’s crucial to partner with reputable developers who have a strong track record of delivering projects on time. Investors should also check that the project has secured necessary financing, local approvals, and legal permits before committing to the investment. It’s also wise to include contractual clauses in your agreement that address delays, providing you with compensation or penalties in the event of setbacks.

Regulatory and Legal Challenges

Navigating Thailand’s property laws can be a challenge for foreign investors. While foreigners are allowed to own condominiums outright, direct ownership of land is prohibited. Instead, foreign investors often need to consider long-term leases (up to 30 years) or the creation of Thai companies to invest in villa development projects.

These restrictions can add complexity to the investment process and increase the risk of legal challenges. Additionally, if the development project lacks proper permits or violates local regulations, the entire project could be halted, leading to significant financial losses. It is crucial for investors to work closely with local property lawyers to ensure that their investment is legally sound and fully compliant with Thai regulations.

Market Volatility and Economic Factors

The real estate market in Koh Samui, like any other market, is subject to fluctuations caused by economic changes, tourism trends, and broader market volatility. Factors such as an economic downturn, a decrease in tourist arrivals, or even global events can impact property values and rental demand. The COVID-19 pandemic is an example of how external factors can dramatically affect tourism-dependent markets like Koh Samui.

Investors should perform thorough market research and consider future trends when evaluating a development project. Understanding both the local economy and the broader real estate trends in Thailand and Southeast Asia can help mitigate the risks associated with market fluctuations. Diversifying investments and maintaining financial flexibility can also provide a buffer against unpredictable market conditions.

Key Considerations for Investing in Development Projects

Investing in ongoing real estate developments in Koh Samui requires a strategic and thoughtful approach. Several factors play a crucial role in determining the success and profitability of your investment. Below are the key considerations to keep in mind when evaluating potential opportunities.

Location Matters

The location of a property is perhaps the most critical factor influencing its value and rental potential. In Koh Samui, properties located near beaches, tourist hotspots, or those offering panoramic views are in high demand and tend to command premium prices. Villas with easy access to the island’s best attractions, such as Chaweng Beach, Fisherman’s Village, or Bophut Hills, can generate high rental yields, especially during the peak tourist season.

It’s also essential to consider future development plans in the area. Real estate projects near upcoming infrastructure developments like new roads, airports, or commercial hubs may appreciate faster in value due to increased accessibility and convenience. For instance, if a planned resort or new luxury hotel is coming up nearby, it could significantly enhance the desirability and value of your property.

Developer Reputation

The reputation of the developer behind the project is another crucial factor to evaluate. The success and timely completion of the real estate development depend heavily on the developer’s experience, reliability, and financial stability. It’s essential to thoroughly research the developer’s track record, paying close attention to past projects, their quality, and whether they were completed on time and within budget.

Established developers with a strong portfolio of completed projects in Koh Samui or other parts of Thailand offer greater peace of mind and significantly reduce the risk of delays or financial troubles. It’s also important to verify that the developer has secured adequate financing and obtained all necessary legal permits and approvals to avoid potential legal or financial issues down the line.

Exit Strategy

Having a well-thought-out exit strategy is vital for any real estate investment, particularly when dealing with development projects. Whether your goal is to hold the property long-term to generate rental income or to resell it for a profit upon completion, it’s crucial to understand your investment timeline and potential exit options.

If your plan is to sell the property after completion, consider its resale value based on factors like location, property type, and current market conditions. It’s important to stay informed about local real estate trends and anticipate how the market might shift in the future.

For those looking to generate rental income, calculate the expected rental yields and factor in the operational costs, such as maintenance, property management fees, and taxes. Understanding how to maximize occupancy rates and attract high-paying tenants, particularly during peak seasons, will help ensure a profitable return on investment.

Building with a Vision for the Future

When investing in real estate development projects in Koh Samui, partnering with the right company is essential to ensure that the project is not only delivered on time but also designed with a deep respect for the natural beauty of the island. This is where Heveatecture’s expertise in sustainable and elegant architectural solutions becomes invaluable. Their commitment to creating luxury villas and resort properties that blend seamlessly with the island’s tropical environment reflects their philosophy of balancing development with nature.

Sustainable Luxury for Modern Investors

Heveatecture’s approach to real estate development is grounded in sustainable practices. They use locally sourced materials, integrate energy-efficient systems, and design spaces that maximize natural light and ventilation. For investors, this commitment to sustainability enhances the long-term value of the property, appealing to the growing demand for eco-friendly luxury villas in Koh Samui. By choosing projects developed with sustainability in mind, investors not only benefit from high returns but also contribute to preserving the island’s pristine environment.

Designing for Market Appeal

Heveatecture understands the evolving demands of the vacation rental market, especially in high-demand areas like Koh Samui. Their designs focus on creating luxurious, functional spaces that cater to high-net-worth individuals, offering features such as private pools, expansive outdoor areas, and panoramic ocean views. By investing in a property developed by Heveatecture, you ensure that your villa meets the expectations of discerning tourists, providing a competitive edge in the rental market.

Conclusion

Investing in real estate development projects in Koh Samui presents promising opportunities for investors looking to capitalize on capital appreciation, generate rental income, and diversify their portfolios. The island’s growing reputation as a premier tourist destination, combined with its breathtaking landscapes and luxury properties, makes it an attractive market for savvy investors. Whether purchasing pre-construction properties or established villas, the potential for high returns is significant.

However, investors must be mindful of the risks involved. Construction delays, legal complexities, and market fluctuations can impact the timeline and profitability of an investment. Navigating Thai property laws, particularly for foreign investors, requires diligence and a good understanding of foreign ownership regulations. Ensuring that your developer has a strong track record and that the project is located in a high-demand area can mitigate some of these risks.

For those willing to take a calculated approach, Koh Samui remains a prime destination for real estate investment, offering not only financial rewards but also the opportunity to own a luxurious piece of paradise. The potential for long-term rental income from a flourishing tourism industry and the increasing value of luxury properties ensures that Koh Samui will remain a key player in Thailand’s real estate market.

FAQs

Investing in development projects offers potential benefits such as capital appreciation, access to lower pre-construction prices, and the opportunity for high rental yields from vacation rentals, particularly in luxury properties.

Yes, foreigners can invest in condominiums outright. However, when it comes to purchasing land or villas, foreign investors need to either secure long-term leases or set up Thai companies to comply with local ownership laws.

Risks include potential construction delays, market volatility, and regulatory challenges involving foreign ownership. It’s important to ensure compliance with local laws and that all legal permits are secured before investing.

Research the developer’s reputation, track record, and portfolio of completed projects. Established developers with proven success reduce the risk of delays or financial difficulties and increase your chances of a successful investment.

Yes, vacation rentals can be highly profitable in Koh Samui, particularly during peak tourist seasons. Luxury properties with high rental yields are especially popular among tourists seeking privacy and upscale accommodations.

To mitigate risks, invest with a reputable developer, ensure all permits and legal documents are in place, and choose properties in prime locations with strong development potential and tourist demand.

Luxury villas with ocean views, private pools, and proximity to popular tourist attractions are the most sought-after by both investors and vacationers, providing excellent opportunities for rental income.

Investing in pre-construction properties often provides lower purchase prices and flexible payment plans, while completed properties offer immediate potential for rental income and are less risky in terms of construction delays.

When choosing a location, look for properties near beaches, tourist areas, or upcoming infrastructure developments. These factors increase the potential for property value growth and consistent rental demand.

Foreigners must comply with Thai ownership laws, which restrict land ownership. However, they are permitted to purchase condominiums and enter long-term leases for villa investments, allowing for secure property investment.